The 5 Bank Accounts That Will Protect and Increase Your Cash Flow

Published: Apr 19, 2024

If you're running a small business, you're probably really good at making money. But managing that money? That might feel like trying to hold water in your hands. Ever used your business account to buy something for yourself by mistake? Or been surprised by a big tax bill or a payroll deadline? If so, you're not alone

This guide is here to help, especially if you're not a fan of dealing with numbers and financial statements. If you're more of a creative person, someone who'd rather focus on the big picture than the tiny details of accounting, you'll find this approach extremely helpful.

You shouldn't have to worry about how much money you're making or whether you can pay your bills on time. Your business should be doing well enough to not only cover your needs but also let you save and invest for the future.

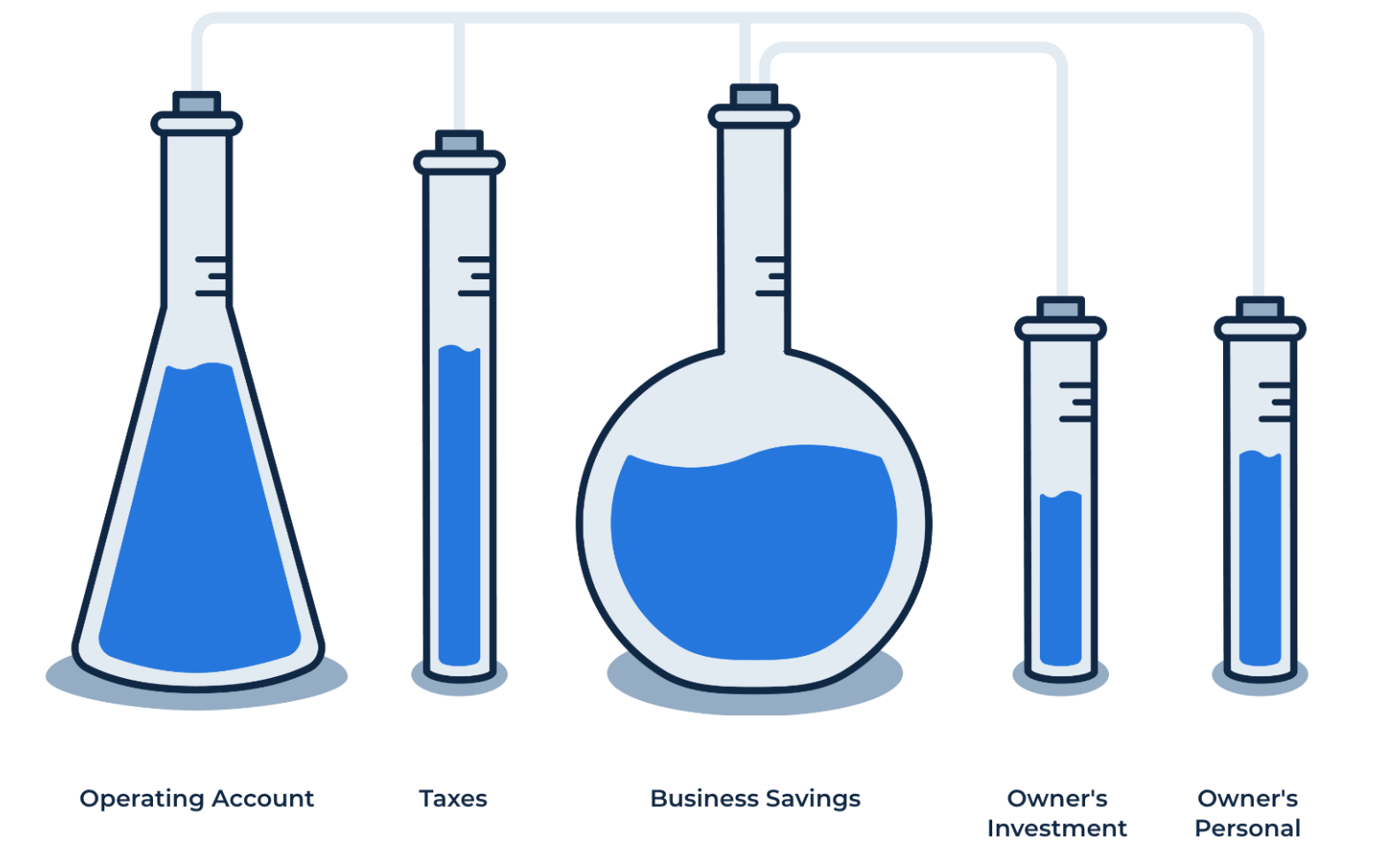

We're going to use a simple plan: set up 5 different checking accounts for your business. It sounds simple because it is, and it's going to make managing your money a lot easier.

Handling your business's money is more than just making sure you're not spending more than you're earning. It's about making sure your business is healthy and has a steady flow of cash, so it can grow and support you for the long-run.

Your 5 Checking Accounts

First, let's break down these five checking accounts you'll be setting up for your business. Think of them as five jars where you're going to sort your money to keep things clear and simple.

- Operating Expenses Account: This is your main jar. All the money you make and spend on daily business operations goes here.

- Personal Account: This jar is just for you. It's where you put the money you pay yourself, so you don't mix up personal spending with business expenses.

- Business Savings Account: This is your savings jar. The extra money your business makes, after all the bills are paid, goes here. It's like your safety net if anything goes sideways.

- Tax Account: Set aside money for taxes in this jar. It keeps you ready for tax time, so there are no surprises.

- Investment Holding Account: Think of this jar as your future jar. Money here is for growing your wealth outside of your daily business operations

Each of these jars has an important job, making sure you know where your money is and what it's for, helping your business run smoothly and grow over time.

Your Operating Expenses Account

The Operating Expenses Account is like the command center for your business's day-to-day money moves. Every penny your business earns lands here first. Then, you use this account to pay for everything your business needs to keep running—things like rent, supplies, and paying yourself and your team.

You want to keep enough money to cover all your business's day-to-day and monthly expenses, plus a little extra for unexpected costs. A good rule of thumb is to aim for a cushion that can cover one entire month of operating expenses.

So if your business spends $20,000 every month on expenses, you want to keep roughly that amount in the account at all times. This will make sure your business operations don't hit a snag because you're short on cash.

By keeping all your operational spending in one place, you can easily see what's going out and what's coming in, helping you make smart decisions to keep your business humming along.

Your Personal Account

Think of the Personal Account as your own financial space separate from your business. This is where the money you pay yourself as the business owner goes. It's your salary for all the hard work you put into running the company.

First, calculate a fair salary for yourself. If you want a salary of $65,000 per year, you’ll want to pay yourself $2,500 every 2 weeks. If your business is growing and bringing in more profit, you may want to increase your salary and start paying yourself $5,000 every 2 weeks—so that you’re making $130,000 per year. The amount is up to you and the profit you’re making.

Paying yourself a consistent salary and putting it into this account helps you avoid the temptation of dipping into the business funds for personal expenses. It keeps your personal spending neatly separated from your business expenses, making it easier to manage both sides of your financial life.

A steady salary also means you can plan your personal finances better, knowing exactly how much you have to spend each month. Plus, it reinforces the discipline of treating your business like a separate entity, which is crucial for its growth and your financial well-being.

Your Business Profit Account

This account is where you celebrate the fruits of your labor. The Business Profit Account holds the profits your business makes after covering all its expenses and your salary. It's a clear indicator of your business's success and growth.

Here’s how it works:

Once you've paid for all the business essentials and set aside your personal salary, whatever profit remains gets transferred into this account. Using the example from earlier, if you’ve got $20,000 sitting in your Operating Expenses Account, anything exceeding that would be split between your Business Profit Account and your Tax Account.

This money is your reward for the hard work and good decisions that drive your business forward. It's also a strategic reserve. This account serves as a buffer for future investments or unexpected downturns, like global pandemics, recessions, or losing a critical team member. Think of it as your business's safety net, giving you the flexibility to navigate through tough times without jeopardizing your operation or dipping into personal funds.

You’ll want to aim to keep six months of operating expenses in this account. If your operating expenses are $20,000 per month, you’ll want to keep at least $120,000 in your Business Profit Account.

Your Tax Account

This account plays a crucial role in your financial planning, acting as the guardian of your peace of mind when it comes to taxes. If you aren’t prepared to pay a tax bill, it can take your company down. The Tax Account is specifically set aside to handle all your tax obligations, ensuring you're never caught off guard when tax season rolls around.

After you've calculated your business's earnings and set aside your personal salary and business profits, a portion of what's left goes into this account. It's essentially saving for your tax bill in advance. This way, when it's time to pay taxes, you have the funds ready and waiting, eliminating any last-minute scrambles to gather what you owe.

We advise consulting with a tax professional about what percent of your revenue you should be setting aside for taxes in your specific state, as this number will vary based on your location.

Your Investment Holding Account

Reaching a point where your business can cover its overhead for six full months without any new income is a significant milestone. It's a sign of stability and success.

When your Business Profit Account exceeds this six-month safety net—let's say your target is $120,000—any extra cash flows into your Investment Holding Account. This is your fifth and final account, and it's one to feel particularly good about. Money moving from your Business Profit to your Investment Holding Account is essentially money going back into your pocket, the owner. This is the cash you're free to use as you wish.

However, it's not just dumped back into your personal account for a reason. The pause before it reaches you is intentional, encouraging you to think about how you use it.

While it's tempting to spend this on immediate splurges like a new car or a vacation, the name 'Investment Holding' serves as a reminder. The smart move is to use this money to make more money—investing in assets like stocks, bonds, real estate, or other financial products that earn you income while you're not working.

This approach is how true wealth is built: not just through hard work, but by making your earnings work for you, generating income passively through wise investments.

Streamline Your Finances

By using all five checking accounts in this way, you create a powerful financial ecosystem.

By categorizing your finances into Operating Expenses, Personal, Business Profit, Tax, and Investment Holding accounts, you're doing more than just organizing your money. You're setting up a system that ensures your business thrives, your personal wealth grows, and your financial future is secure.

Implement the five-account system and watch as your business becomes more stable, you feel more in control, and your financial worries disappear.

To make managing your money easier, use the Cash Flow Calculator inside the Small Business Flight Plan. It automates these crucial calculations, allowing you to forecast your finances across all accounts from 1 to 12 months, set your custom tax rate, and clearly see your monthly and yearly net income.

Download the Small Business Flight Plan here: