5 Financial Questions to Ask Before Making an Important Decision

Published: Apr 19, 2024

A shocking number of business leaders go with their gut on whether or not they have the capital to fuel whatever project they want to embark on.

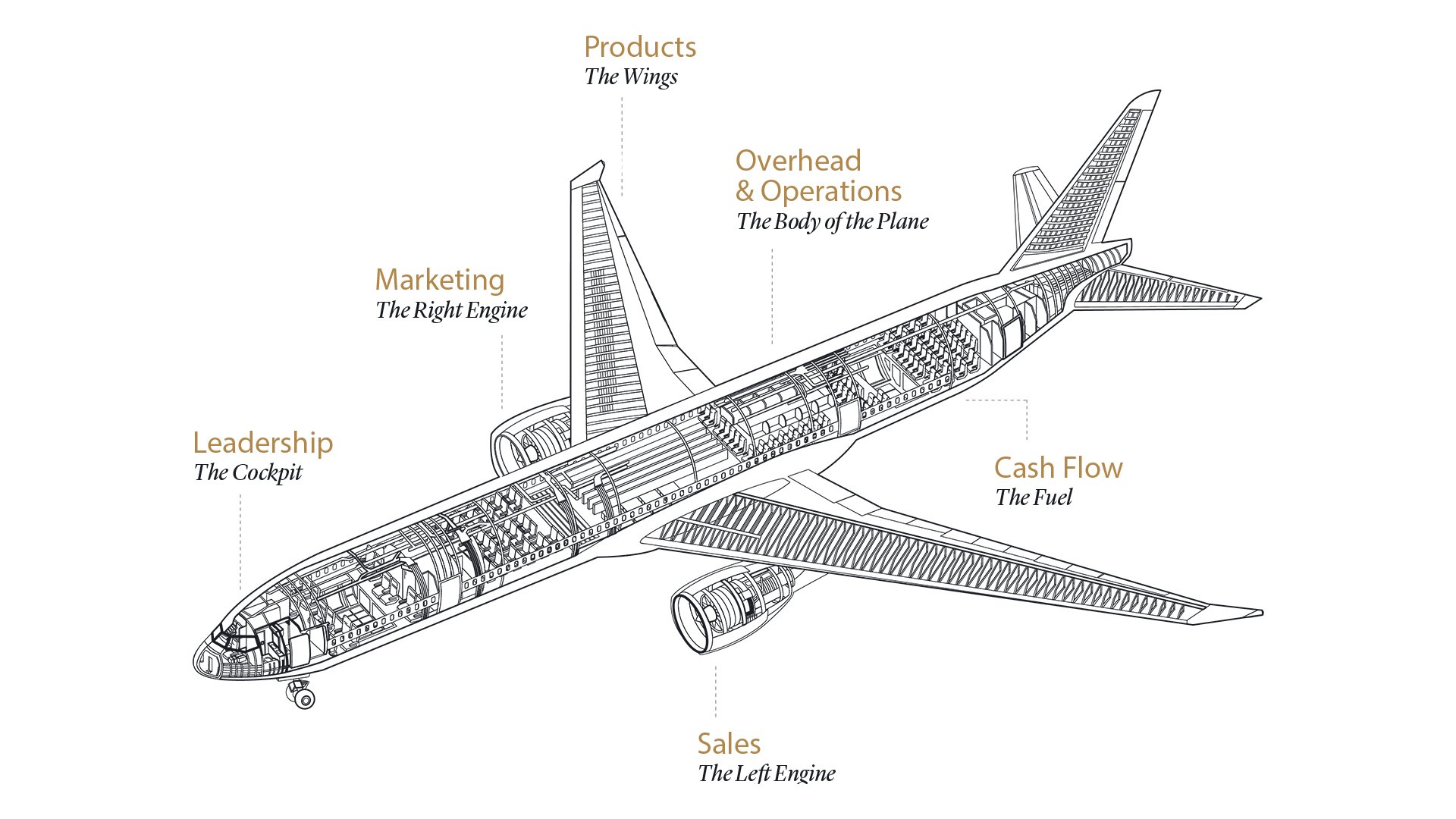

Just like an airplane needs fuel to stay airborne, a business requires cash flow to keep its operations running smoothly. And a good pilot would never trust their gut on whether they have enough fuel.

As business owners, we need to monitor cash flow closely. If you run out of cash, your business is done! It's actually the reason 82% of small businesses fail. It's not because they don't have a great product or great systems. It's because they run out of money.

The Fuel Filter

In a business, accessible money in the bank is fuel. That's why every business decision should pass through the "fuel filter." In every decision that you make, it is important to ask yourself how this decision will affect cash flow. How will it affect our ability to have cash in the bank? The fuel filter ensures that decisions align with maintaining a healthy cash flow and ultimately sustaining the business.

So, let's explore the five crucial cash flow questions to ask before creating a new product or making any pivotal business decision and pass through the fuel filter.

Five Financial Questions for Decision-Making:

1. Cash Needed

How much cash will we need to create this product before we launch it? Break down all costs involved in creating the product. This would include materials, manufacturing, and any other production costs.

2. Profit Margin

What is our profit margin on this product? To calculate your gross profit margin, let's go back to Finance 101 and look at this formula from investopedia:

Your Costs of Goods Sold would include all of the costs you determined in question 1 that relate directly to the production of your new product or service. It would exclude indirect costs, like marketing, sales, and overhead.

While a higher profit margin percentage is always better, profit margins vary depending on the industry you're in. You'll need to research industry benchmarks and competitors to better understand how you're performing and to set goals for improvement.

3. Timeline for Profit

When will we start making money on this product? There are four key steps you need to take to establish a timeline for profitability:

- Figure out if there is demand for your product. Conduct market research or interview your customers to gauge their willingness to purchase the product.

- Consider the production and launch timeline. How long will it take to bring your new product to market?

- Create your marketing and sales strategy. How will you promote the product, reach your target audience, and drive sales?

- Determine how much you'll charge for your product. Make sure to price your product competitively while leaving room for profit margins to finding the right balance between affordability and profitability.

4. Impact on Revenue Streams

How will launching this product affect our other revenue streams? Your new product could attract a whole new customer base, resulting in an increase in overall revenue.

For example, if your business primarily sells high-end luxury items and decides to introduce a more affordable line, it could potentially reach a wider audience and generate additional sales without cannibalizing the existing customer base. On the other hand, launching a new product that solves a similar problem or directly competes with any of your existing products could lead to a redistribution of sales and revenue.

5. Enhancing Profitability

How can we make this product even more profitable to increase our profit margin?

Here are a few ideas to make your product even more profitable:

Upselling and Cross-selling: Encourage customers to spend more by offering additional products or upgrades that complement their purchase. For example, a technology company could offer extended warranties or premium features for an extra fee.

Customer Loyalty Programs: Implement loyalty programs to incentivize repeat purchases, build customer loyalty, and increase customer lifetime value. Offer exclusive discounts, rewards, or personalized experiences to encourage customers to choose your product over competitors.

Product Iterations: What iterations of this product could we sell for even more money? Could you offer a premium version of your product?

These five question are questions you want to constantly ask about your products in order to increase cash flow. Use these questions to stimulate thought regarding each of your revenue streams. By constantly evaluating how decisions impact cash flow, your business can ensure its financial health.